Elevations Credit Union Mortgage Tools

Project Summary: Elevations prides itself on their individual service, especially in the mortgage business. But there are parts of the mortgage business that are ripe for automation, such as preliminary data collection used to determine if a borrower is a good fit for a mortgage with Elevations. There are also parts of the mortgage business in which borrowers would prefer to have the autonomy to determine whether they are interested in a mortgage, such as the refinance business. The project was completed in phases over a few years:

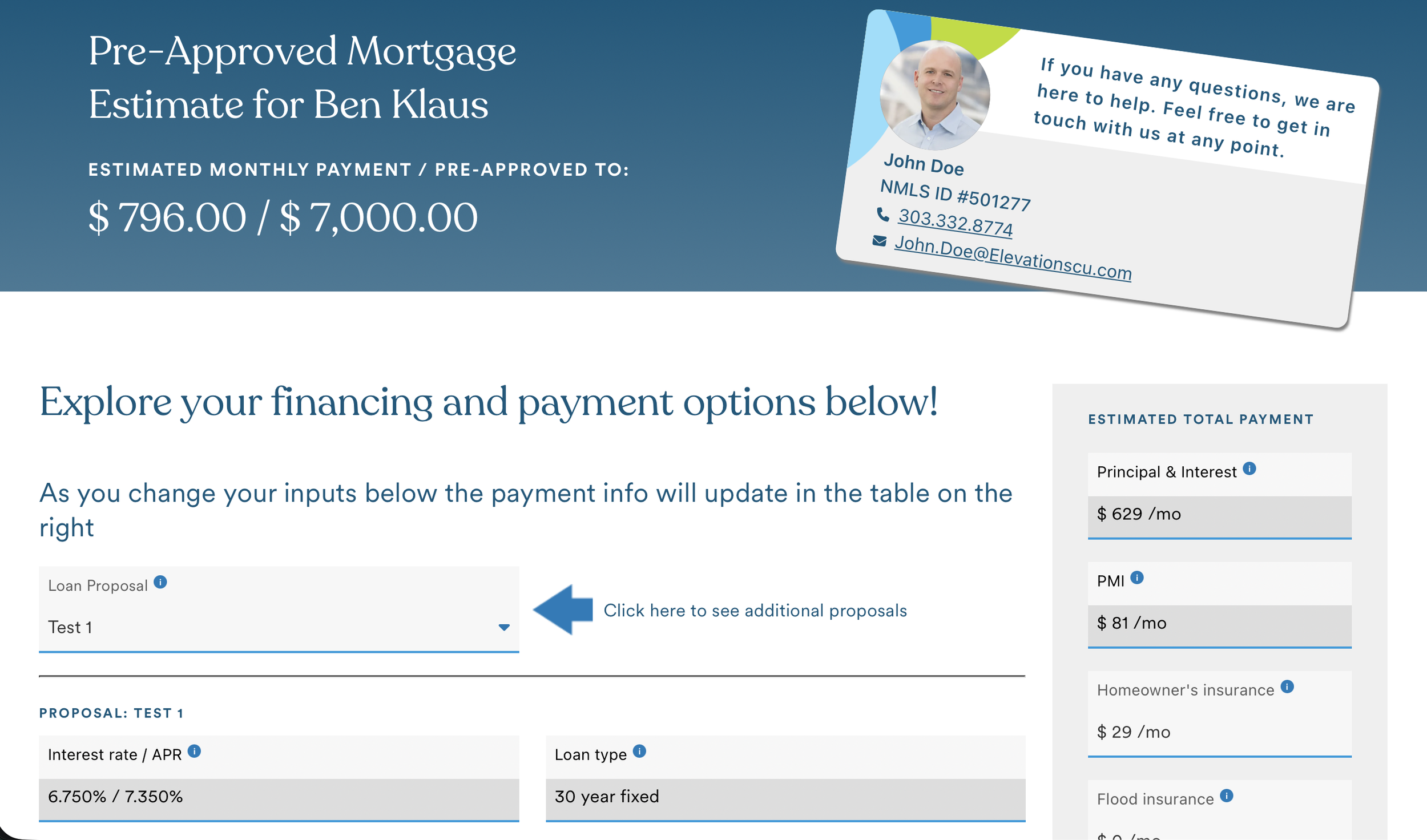

First Phase: collect information from borrowers looking to purchase a new home. Once the information was collected, it enabled a digital funnel in which Loan Officers would provide borrowers with some loan options. These loan options included the total picture of the loan; rate, payment, detailed breakdown of fees and costs, escrow amounts.

Second phase: enable borrowers to check the refinance and home equity rates available for their specific scenario. Many mortgage companies will display generic rates but they’re almost never the rate the borrower will end up with due to all the factors that affect rates and costs. Our tool was to take the address and pull current rate and current home value from public records, then connect that to the borrower’s credit score to give a more accurate loan proposal.

My Role: In the first phase, I was the UX Designer working with the stakeholders in the mortgage team. I designed the tool using Miro and Figma. Once designed, I acted as a resource for an internal dev team alongside the digital product team.

In the second phase, for the refinance tool, we moved to an outsourced development team and I assumed the Product Manager role as well as the UX Design role.Biggest Challenge: given the complexity of the mortgage business, the biggest challenges were in balancing feature requests with ease of use for borrowers. Most borrowers don’t understand all the small nuances of different mortgage types. To incorporate every type of mortgage into a top of funnel product would sometimes add complexity that wasn’t worth the change.

For any new feature proposed by the mortgage stakeholders, I would first work to find ways of hiding the complexity from the user while still adding the benefits.

When that was not possible, I would have a cost benefit conversation with the stakeholders.